Interested in keeping your finances in check? Wish to take control of your spending habits? The Boba Finances app might just be the solution you are looking for!

Why did I make this app?

Two years ago, I set off to London as an international medical student from Singapore. As I started making preparations before starting university, I wanted to take matters into my own hands. Hence, I started off with creating a google spreadsheet to track my spendings. As I sought for greater convenience in tracking and updating my finances, I turned to Google Appsheets – to create my own personalised finance app to integrate all the tools I needed to organise my finances.

If you would like to find out how you can create something similar for yourself, check out my experience making this app here: 5 Easy Steps To Create an Appsheet Budgeting App

Two years later till now, I have gradually improved on the layouts of the app, and an idea dawned upon me: will it be possible to also share this simple solution with others? After tinkering for a while, I managed to create a setup for my app, for others to use as well.

Boba Finances 🧋

What I hope this app can do is to provide the key features that other finance trackers boast, while letting people who use this app have full autonomy and privacy over their own finances.

Ideally, I hope this is useful for students in general, as well as for international students, where it can get messy having to plan your finances while accounting for currency exchanges. However, I think that learning to be financially prudent or savvy doesn’t have to be difficult. I think it takes just a bit of effort daily to keep your expenses in check!

Table of Contents for this article:

- Key Features 🧋

- App Design and UX 📱

- Additional Customisations 🤖

- Usage Options 💭

- Pricing 🙃

- Future Updates 🌱

- Take Control of Your Money with Boba Finances 🧋 Now!

Key Features of Boba Finances 🧋:

- Privacy and security 🔐: This includes Fingerprint Lock for Boba Finances which can be easily set-up, as well as full ownership over data in both Appsheets as well as the corresponding Google Sheets.

- Intuitive Platform Design 😌: Easy to use forms for inputting cash in (earnings) or cash out (spendings) details.

- Convenience ⌚️: A more convenient way to track finances instead of having to navigate between both Google Forms and Google Spreadsheets to manage your money. Additionally, it allows you to organise your money from different currencies and different bank accounts into one simple app!

- High Degree of Flexibility in tracking finances 💷: Multiple views that range from daily, weekly, monthly and annual overviews of finances.

- Additional Customisations 🤖: I have also trialled and tested successfully ways to automate some inputs (instead of having to input them manually) to save time. We can also include more action buttons which open up pre-filled forms that can be added into the app!

Important things to highlight would be the layout of the App.

Boba Finances App Design and User Interface 📱:

To introduce you to some of the views you can expect to see in your personalised app, here are some examples shown below.

Forms 📝:

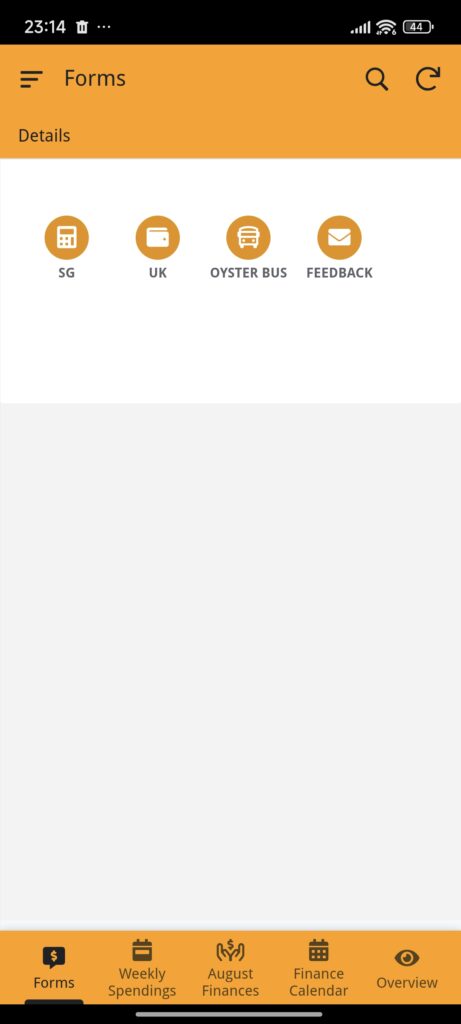

When the app opens and syncs, the first view you would see is the forms view. This opens up to this view with a few intuitive and simple to use action buttons. The main ones would be:

- SG Finances Form (to input your spendings/earnings in Dollars)

- UK Finances Form (to input your spendings/earnings in Pounds)

- Feedback Form (this would open up into an email draft to me – for modifications and upgrades you would like to request, or any troubleshooting if needed.

- Oyster Bus: This is an example of an action button that opens up a pre-filled form. As the bus fares in London are standardised at £1.75, it is a viable option for a pre-filled form.

How to Fill in a Form in Boba Finances

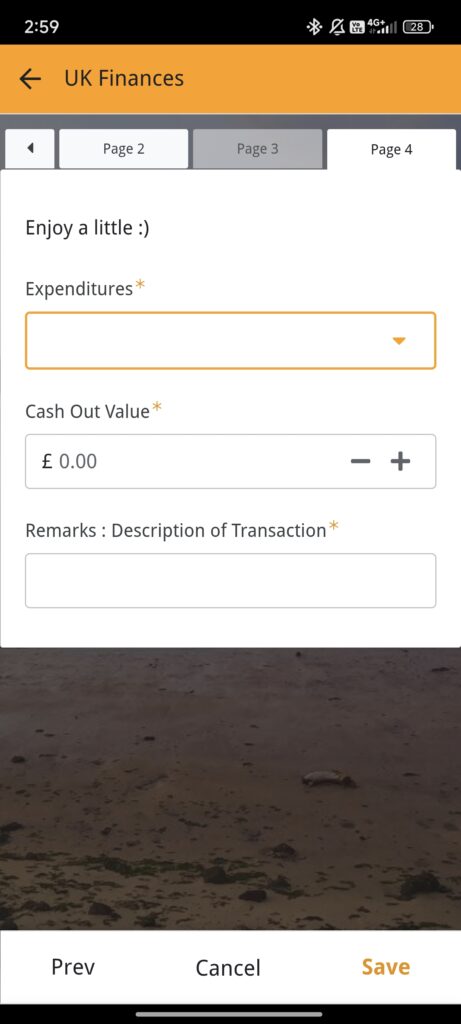

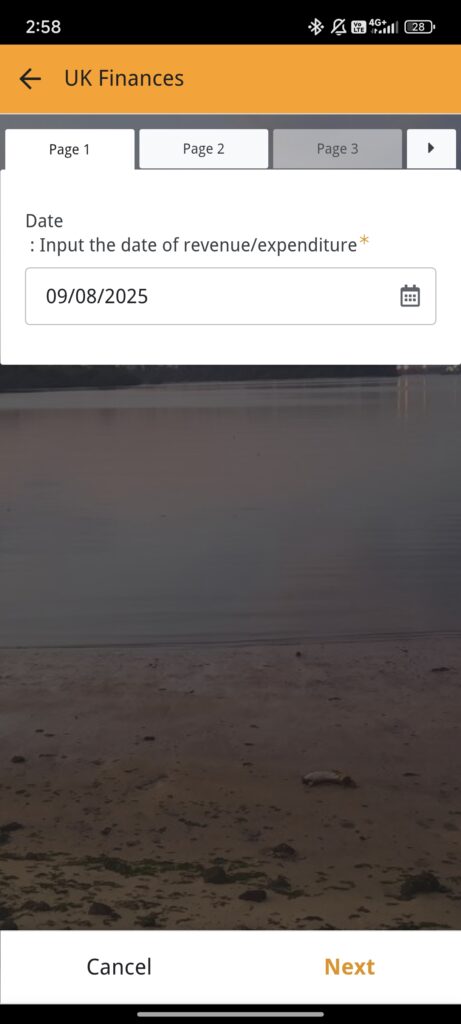

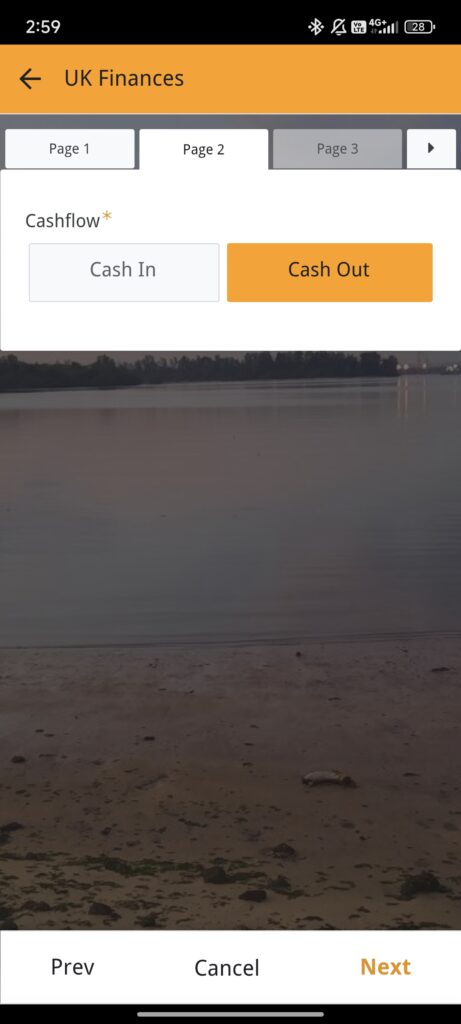

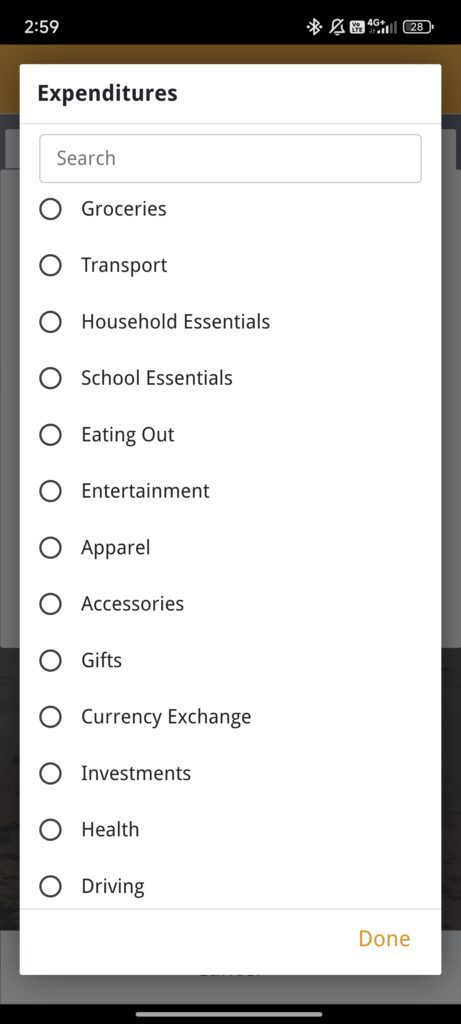

To navigate the forms for the apps, let’s have a look here. Firstly, we start off with inputting the date, followed by the type of cashflow. Next, there will be an automatic pop-up for you to input the category. Lastly, fill in the value of cash in/cash out as well as a brief description. And that’s it, you have submitted an entry!

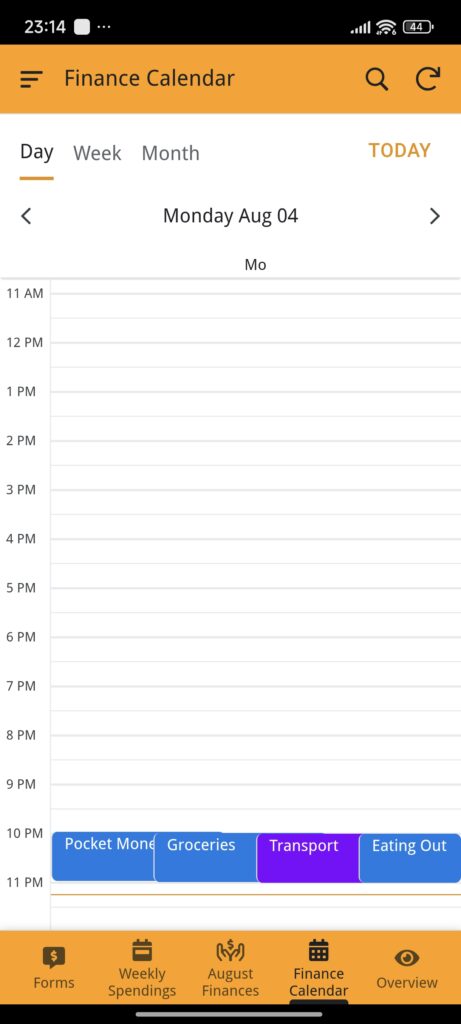

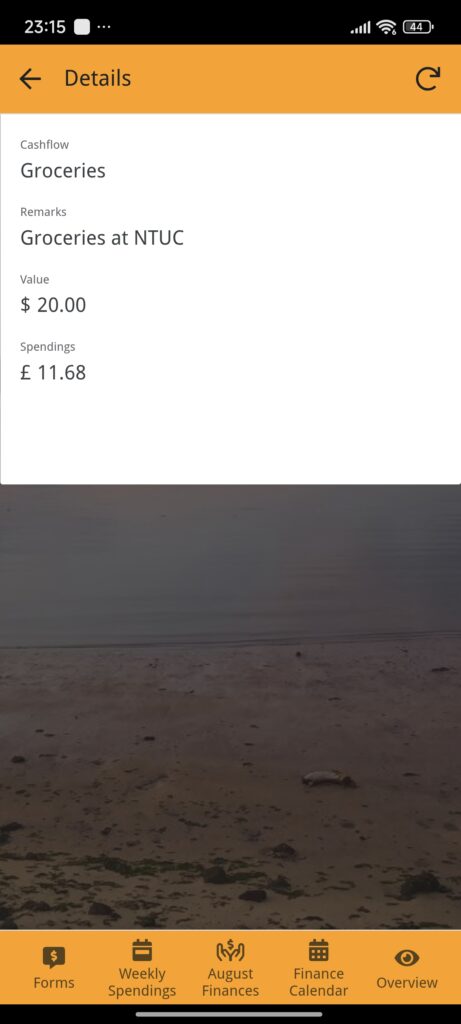

Calendar View 🗓️:

In this view, it shows an overview of the specific entries put in in a calendar format, if you would like to check and verify if the details are correct. When you click on any of them, it will open up into a neat and concise detail view with the breakdown of your entries.

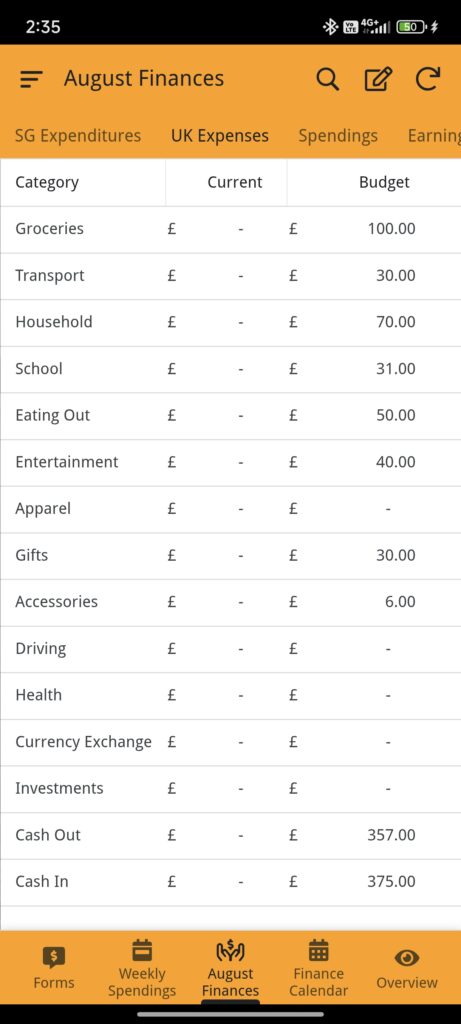

Monthly Budget Tracker 💰:

The views below showcase a breakdown of your actual expenses in the current month, neatly placed alongside a budget column, which can be edited and set by yourself. Hence, this can help you to set your personalised spending goals and monitor your expenses based on the different categories. Alternatively, the app can also support multiple different views for tracking finances, including the use of pie charts or bar graphs. In this case, I think having a table format as shown below is easy on the eye and makes it easier to interpret.

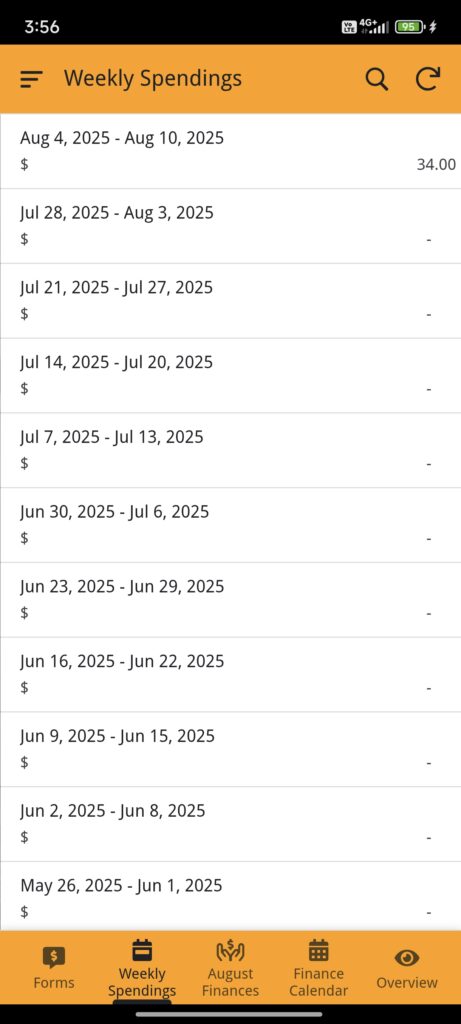

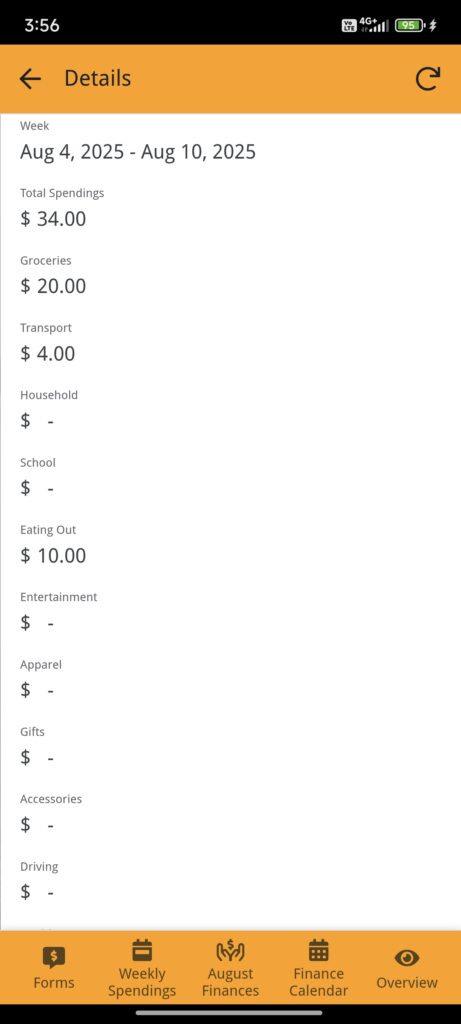

Weekly Spendings 💸

I included this view to accommodate for different preferences in analysing finances, where some might consider doing it weekly!

Subsequently, I have added a summary of total amount spent in a week (from Monday to Sunday) in the main view. This view is updated dynamically, with the most recent week automatically being generated at the top. When you click into any column, it will bring you to a breakdown based on all the different categories.

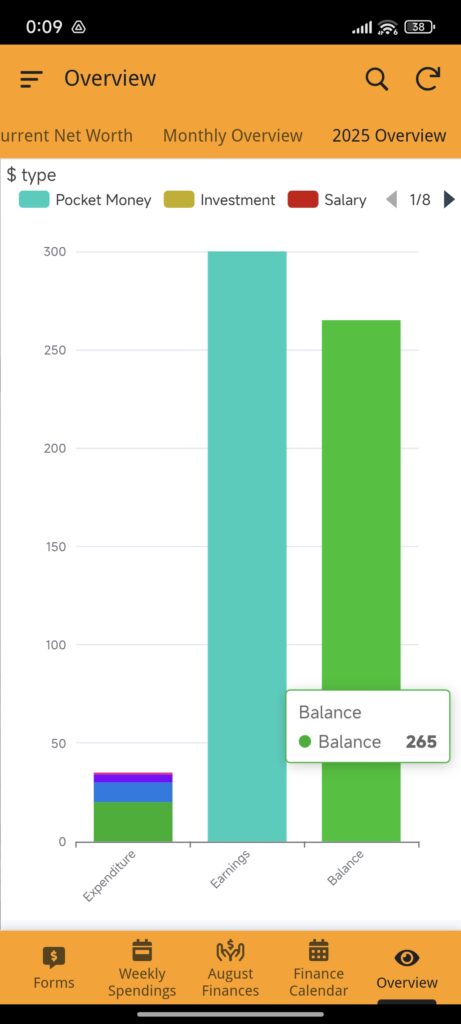

Annual Overview ⌛️

I left the annual overview as it is here. You can have a snapshot view of each category in expenses or earnings when your cursor is over each component!

Additional customisations 🤖 for Boba Finances:

To give you the most utility out of Boba Finances , I have also included a list of modifications that I can personalise for you:

- Add-ons with app script: For automation of recurring spendings/earnings like phone bills, household bills (electricity, gas, water), as well as memberships. 🏦

- Ability to incorporate your investment portfolio 📈

- Being able to securely lock your app with digital fingerprints/Face ID 🔓

- I can customise the app icon and background image 🙂

- I can also change the colour scheme to suit your liking 🎨

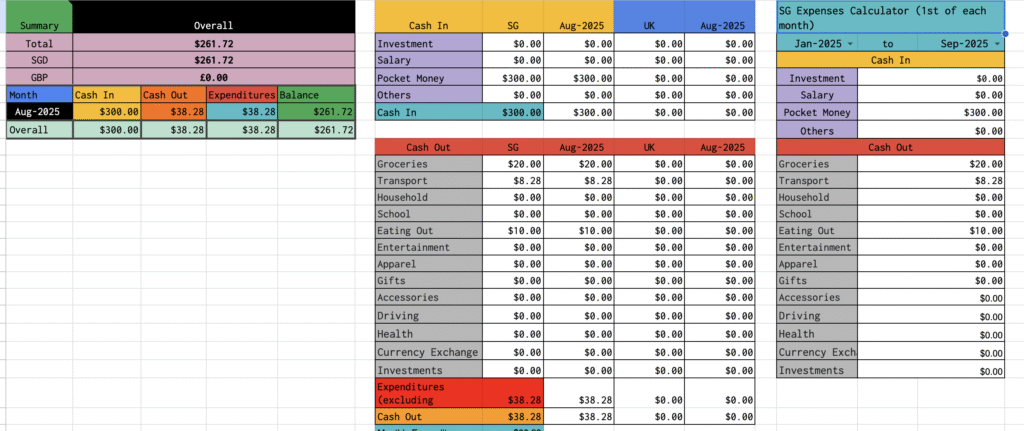

Google Sheets Functions 💻

Alternatively, the google sheets which serves as the main database for Boba Finances, also includes a few functions apart from those already in the app. If you would like to extract data for a specific date range (for example, between January 2025 and September 2025), you can also do so using the dropdown buttons!

Usage Options 💭

Currently, Boba Finances App can be presented in a few different formats. For example, one of the formats would be for overviews to be presented in dollars. Please specify the main currency you would like the app to be in!

- The app can be presented mainly in Dollars (SGD), with inputs in pounds displayed in separate views as well.

- The app can be presented mainly in Pounds (GBP) with inputs in dollars displayed in separate views as well.

- I can also update the main currency used and the formulas in the spreadsheet as well. Other currencies include Euros, Australian Dollars, USD, etc.

Pricing 🙃

In order to facilitate the process of transferring ownership of my app layout and general functionalities to you,

Additionally, I will also contactable as technical support, should there be any troubleshooting/updates required.

With just $8/£5, you can expect to receive:

- Full access to your very own customised Boba Finances download file and its appsheet data, sent to your email!

- Full access to the Google Sheets, which serves as a backup option for the app!

- Instructions on how to set up Fingerprint Lock/Face ID Protection on your app (subject to availability on device)

- Any additional customisations listed below, upon request!

All in all, I hope you would consider it a tiny but worthwhile investment in your financial journey! 😊

Future Updates 🌱

In the future, I might be able to work on incorporating multiple currencies, more than just two, depending on demand.

Currently, this is more or less catered for Singapore/United Kingdom Users with both options to either have your finances as a whole presented in SGD or GBP.

As I actively use my own app, I will fine tune it as and when I have new modifications to make!

Hence, I hope that Boba Finances can make money matters intuitive and easy to understand. Furthermore, by customising it based on your individual needs, I hope that it becomes an app that simplifies and streamlines your tracking needs!

Take Control of Your Money with Boba Finances 🧋 Now!

📝 Written Step by Step Guide Provided to Set This Up

Your handy app for:

💸 Live tracking of Account Balances (Net Worth) automatically

💰 Intuitive Platform Design 😌: Easy to use forms for record your earnings and expenses.

📆 Monthly, Weekly, Annual Overview: Track your income, expenses, savings rate month by month, week and year.

🎯 Saving Goals

🤖 Track and Automate Active Subscriptions

🤖Additional Customisations: Pre-fill Buttons can be included upon request.

Flexibility in tracking finances 💷: Multi-currency tools incorporating both Great British Pounds (GBP) and Singapore Dollars (SGD) currencies.

Privacy and security 🔐: Full ownership over data in both Appsheets as well as the corresponding Google Sheets for your personal finance app.

Disclaimer – All digital products are non-refundable. This Appsheet/Google Sheets Finance Tracker (Boba Finances) is protected by copyright and is a property of Woo Zhi Xiang. It is intended for personal use only.

Do leave a comment before if you found it helpful, or if you require some clarifications on anything mentioned here~